The best value in the world of fine wine must be vintage port. Where else can you find fabulous 50-year-old bottles for US$300 to US$400? Even older bottles from such great years as 1927, 1945, and 1948 aren’t much more expensive.

The best names in new vintages, such as Taylor Fladgate, Fonseca, Dow or Graham, are only about US$100 to US$150 a bottle. And these are great wines that will improve for hundreds of years. They have the pedigree and the quality combined. Plus, great old vintages from the 18th and 19th centuries are drinking beautifully today.

“Port has not increased in price in the same way as top-end Bordeaux and Burgundy, simply because it is a much narrower market,” says Paul Bowker, one of the owners of London-based wine merchants Wilkinson Vintners, which is one of the best sources for aged vintage port. “There are far fewer buyers in the world, although those that do buy more than make up for their numbers with their passion.”

John Kapon, president and CEO of the wine auction house Acker Merrall & Condit, puts it this way: “We auction the top brands of port when they come our way, but many port collectors prefer to keep them.”

Investing in wine is a profitable alternative investment option for investors and wine drinkers to diversify their portfolios. Additionally, the fine wine asset class has a low correlation with the global stock market and is inflation-proof.

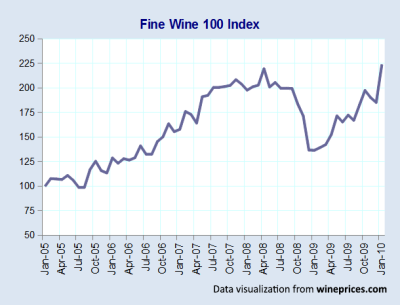

Here’s how: The fine wine market has outperformed most global equities and exchange-traded funds (ETFs) and is less volatile than real estate or gold. The Liv ex fine wine index has returned +11.1% year-to-date (YTD), which has beaten gold (-4.4% YTD), Dow Jones (-12.21% YTD), and the S&P 500 index (-15.9% YTD.)

With the rising inflation levels in recent years, the stock market is more volatile than usual. This makes 2024 a great time to start investing in an alternative asset class like fine wine.

Fine wines have historically outperformed the US stock market (the Liv-ex 100 index grew by 270.7% between 2001-2021, while the S&P 500 index grew by 262%.) Additionally, in 2021 the Champagne index grew by 40%, while the Bordeaux index (tracking the performance of First Growth Bordeaux wine labels) increased by 50%.

So even when the economy stabilizes, fine wine will still be a good alternative asset worth adding to your portfolio. However, remember that fine wine is a long-term investment, so you’ll need to hold onto your bottle for a few years before making a profit.

Copyright: © 2024 Zephyr Escrow .

Address: 305 West Broadway, San Diego, CA 92101, USA

Email: support@zephyrescrow.org