Choosing your investments is more than selecting stocks of companies with high growth potential, large dividend yields, or low price-to-earnings ratios.

When you select your investments, you not only choose which securities you own and how many shares you own of each, but either wittingly or unwittingly set each as a portion of your overall portfolio. As you do so, you inherently define your risk-return profile.

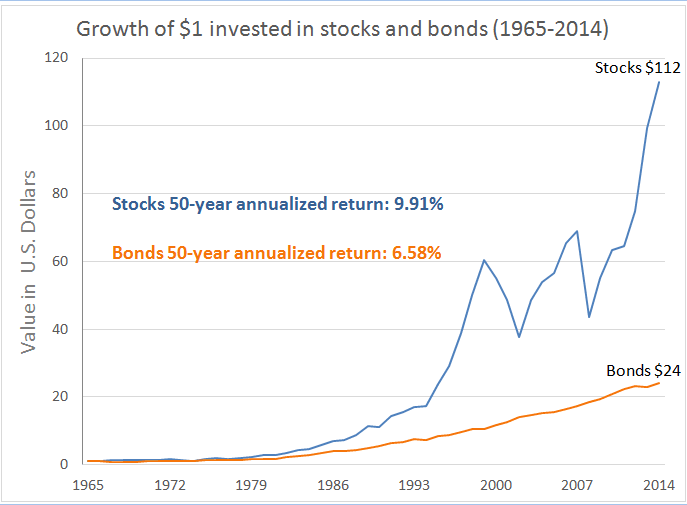

This is because some assets are inherently riskier than others, with greater potential for returns. Others carry less risk, but also provide less opportunity for larger returns. The securities you choose and the portion each accounts for in your overall portfolio should align with your investment goals and risk tolerance. For example, an individual with high risk tolerance or long investment horizon may invest more money in stocks, while an individual with lower risk tolerance or a shorter timeline may invest a larger percent of their money in bonds. This same principle applies within asset classes, as well, with some stocks carrying more risk than others.

The targets you set for each security in your portfolio ultimately make up your asset allocation. In other words, if 70% of the money in your portfolio is invested in stocks and the other 30% is invested in bonds, your asset allocation is 70/30.

Choosing the right mix of stocks and bonds can be one of the most basic yet confusing decisions facing any investor. In general, the role of stocks is to provide long-term growth potential and the role of bonds is to provide an income stream. The question is how these qualities fit into your investment strategy

Over time, some securities in your portfolio will potentially earn more in returns or dividends while others earn less, thus altering your overall asset allocation. Rebalancing is the process of bringing these investments back to your original targets to maintain the risk-return profile you initially set for your portfolio.

Think of it like this:

Let’s say your portfolio consists of two stocks, each set to 50% of your overall portfolio: Stock A and Stock B. Stock A is a growing tech stock with higher risk and higher potential for reward, and Stock B is a blue-chip industrial stock with stable earnings — a safer investment with less potential for outsize returns.

Suppose that after one year, Stock A earned higher returns than Stock B, and now accounts for 60% of your overall portfolio rather than 50%. Stock B now accounts for 40%.

Your risk-return profile has now shifted in favor of the riskier security. If you wish to keep your portfolio aligned with your portfolio goals and risk tolerance, you’ll want to rebalance and bring each stock back to 50% of your portfolio and maintain your chosen risk-return profile. So why rebalance your portfolio? Long story short: rebalancing keeps your portfolio on track and ensures it doesn’t skew toward too much risk or too little reward.

Bonds represent loans made by investors to companies and other entities, such as branches of government, that have issued the bonds to attract capital without giving up managing control. A bondholder, in effect, holds an IOU. Bondholders do not share in a company's profits. Rather, they receive a fixed return on their investment. This return, stated as an interest rate on the bond, is called the "coupon rate" and is a percentage of the bond's original offering price.

Bonds are issued for specified time periods. When the bond expires and the principal (original investment) is returned, the bond is said to have matured. Bonds can take as long as 30 years to mature. Time to maturity and the issuer's ability to make good on its payment obligations are the two most important factors in choosing individual bonds to purchase. Every bond carries the risk that a promised payment will not be made in full or on time. As uncertainty of repayment rises, investors demand higher levels of return in exchange for assuming greater risk.

Copyright: © 2024 Zephyr Escrow .

Address: 70 Park Avenue, New York, NY.

Email: support@zephyrescrow.org